The virus driven lockdown brings with it a massive transformation of working processes. Video conferencing, document sharing, and cloud solutions have been swiftly adopted to keep operations up and running. The efficiency of digital tools has been tested, approved and introduced in mere days. We would like to assume that this precedes a tremendous surge in further digitalization in the years ahead.

Introducing a new solution to support portfolio recovery check media campaigns

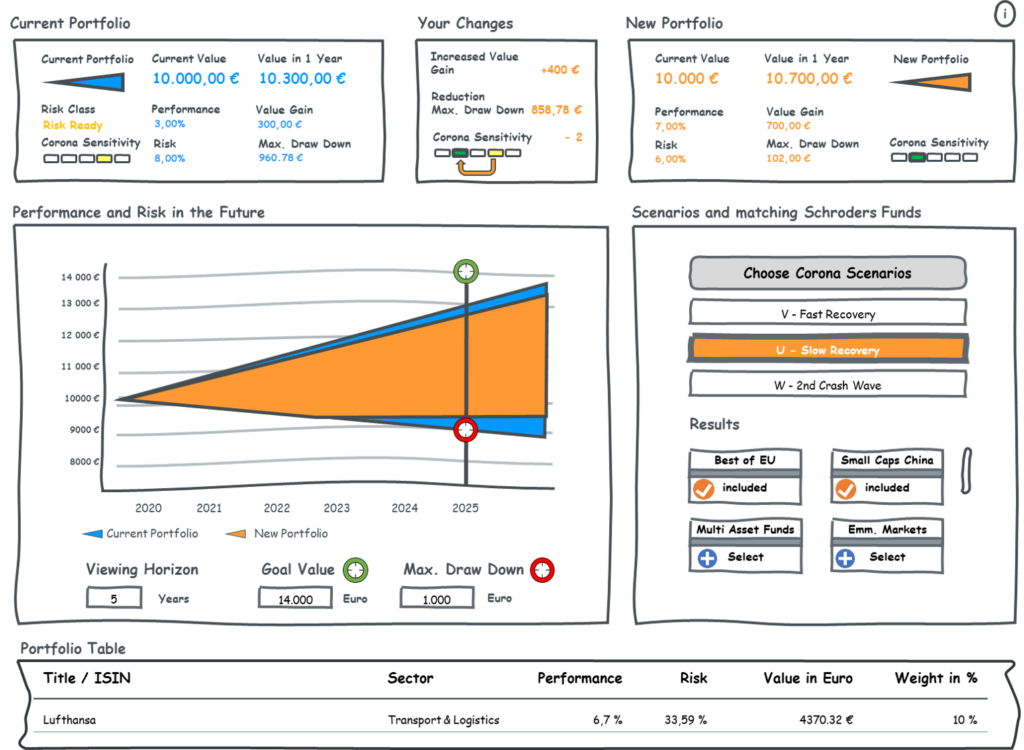

Digital changes are transforming work with unprecedented speed and efficiency, and we suggest to exploit an innovative functionality that delivers unprecedented value for investors. An easy-to-use tool that provides orientation for investment customers: A Post-Corona Scenario Simulation Tool. Users can bring up their individual portfolio and see various market scenarios that have been defined. Then, choosing the scenarios of interest they can see the impact on their investments alongside some suitable investment products they can test in their portfolio.

With the tool’s available functionality, financial service and product providers can provide guidance and orientation in volatile times. Although the Post-Corona Scenario Simulation Tool is predominantly intended as an information tool, its functionality can also be used in an advisory context if regulatory requirements are fulfilled.

Such a tool benefits not only the participating end customer but also the advisor who is enabled to “translate” sound market research into the individual portfolios of his clients. Such a tool can show the impact of any given market scenario on an individual portfolio. The channels in which such a tool can be offered vary widely: on premise, publicly available, or in cooperation models with print and online media partners for attention and traffic generation – all channels and terminals are possible.

Competitive advantage is often described as being reached in three ways: producing more at a lower unit cost (scale), achieving a greater production variety (scope), or pushing for improvement and innovation (learning). Our Post-Corona Scenario Simulation Tool delivers on all of these three drivers. We can offer private banking quality at very low unit costs, deliver unmatched scope in a way that impresses many investment customers, and, with its individual methodology, it is a clear improvement to the more formatted services financial service providers are usually offering.

Functional background

We provide an intelligent investment decision support tool combining only four easy to use widgets (i.e. small functional elements through which the user can reach a technical service). First of all, users can enter their portfolio positions and the number of instruments they have. Then four widget’s functionalities can be used for analysis and scenario simulation:

The Chart-Widget visualiszes the users’ investments in easy to understand graphics. Optionally, users can also see the location of their portfolio in comparison to some benchmarks including 5 areas of individual risk level and can freely chose to understand their investments in the context of personal risk.

With the Scenario-Widget, the user can select between three post-corona scenarios. Each are briefly described and, depending on the chosen scenario, several products with a good fit are shown. Selecting products adds them to the portfolio. Their simulated effect on the user’s portfolio is visualized.

Looking at the What if-Widget users can see and compare the key figures of the current and of the modified personal portfolio: the money they most probably will gain in a year but also the maximum loss they might incur in both cases. They will also see and check the risk type people usually have with such a portfolio. Corona specific is the level of sensitivity their portfolio has for the available post-corona scenarios.

Methodologically a twostep procedure is applied. First, the portfolio is analysed with a service that calculates risk (as volatility) and expected return. Second, both values are used to simulate possible portfolio developments with a Monte-Carlo Methodology, unrivalled in its flexibility for the integration of non-parametric assets. We have a service available for that and it produces animated and appealing visuals of real-time scenario simulations. Of course, multiple scenarios and scenario periods can be combined and compared with each other.

Please get in touch with us if you are interested or want to explore possibilities.

Munich, 2020 04 23

Read on:

Portfolio Consulting as a Process: Simulation-Based Client Orientation